GAP

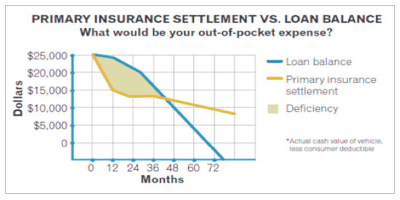

When your vehicle is stolen or deemed a constructive total loss by your insurance company, you can be left in a tough financial bind, owing thousands of dollars after your primary insurance carrier settles. Nothing is worse than having to come out of pocket to cover a loss like this or having to continue making payments on a vehicle that you no longer have.

Guaranteed Asset Protection, or “Gap” as it is known is the number one aftermarket product being marketed today, and for good reason. Gap insurance protects you from large potential losses.

WHY THERE IS A GAP

Negative equity occurs when your vehicle is worth less than what your outstanding loan balance is. This puts you at risk because in most cases your auto insurance policy will not pay out more for repairs or replacement than the vehicles market value at the time of loss. Here is an example of how negative equity happens:

Your Loan/Lease Payoff: $20,000

Your Loan/Lease Payoff: $20,000 - Vehicle Value As Determined By The Primary Insurance Carrier $16,000

- Primary Insurance Deductible $500

- Your Responsibility Without Gap $4,500

- Gap Benefit $4,500

- Your Out-Of- Pocket Expense With Gap Protection $0

WHAT CAN GAP DO FOR ME?

- Provide low cost – big dollar protection

- Eliminate large out-of-pocket expenses after a total loss settlement

- Avoid financial hardship

- Prevent an outstanding deficiency balance from being added to a new loan

- Protect your credit rating

- Gets you into a replacement vehicle quickly

WHO SHOULD CONSIDER GAP?

If you own your vehicle outright or have a lot of equity in it such as a large down payment, you probably don’t need Guaranteed Asset Protection (Gap). If you fall in to any of the categories listed below you should consider purchasing Guaranteed Asset Protection (Gap).

- Taking out a loan with an extended term– A longer loan term not only means lower payments, it also means you build equity in the vehicle much more slowly.

- Depreciation– All cars depreciate, but some lose value much more quickly than others. According to some estimates, certain cars lose as much as 30% of their value within the first three months.

- Putting little or no money down– If you finance all or nearly all of the price of the car, you could be upside down as soon as you drive home, because a new car depreciates most at the moment it becomes “used.”

- Borrowing more than the purchase price– Borrowers who finance the tax, license, and registration, or extras, will find themselves upside down before leaving the lot.

WHY MEMBERFIRST GAP?

The MemberFirst Guaranteed Asset Protection (Gap) program provides more coverage, protection and value than any other program available! Compare the MemberFirst Guaranteed Asset Protection (Gap) program with any other that you are currently using or may be considering, and we know you will find they come up short!

MemberFirst offers our members the industry’s most feature-rich Gap program available today. The MemberFirst Gap program provides unique and very important features not found in any other Gap product.

- MemberFirst provides all risk coverage – Others may only cover total losses due to theft or auto accidents. What about falling trees, vandalism, tornados, hurricanes, floods or fire? MemberFirst covers any insured peril!

- MemberFirst pays from the primary insurance company settlement – Others may calculate total losses from Actual Cash Value, often low-balled by unethical insurers, causing a Gap on the Gap!

- MemberFirst has no cap on over advance – Others may calculate total losses from 100% up to a maximum of 150% of the MSRP/NADA valuation. MemberFirst has no back-end cap!

- MemberFirst covers up to $1,000 of the member’s primary insurance deductible – Others may only cover $250 to $500 of the member’s primary insurance deductible. Where allowed by law, MemberFirst covers the state maximum of $1,000!

- MemberFirst covers up to a $50,000 Gap – This is many times what some companies pay!

- MemberFirst is fully insured by an “A” rated carrier – A definite must in today’s uncertain times!

- MemberFirst will provide Gap coverage even if the member does not have full coverage insurance at the time of a total loss – With many Gap providers, the Gap waiver is null and void if there is no full coverage insurance in force at the time of a total loss. MemberFirst will still cover the Gap if it exists.

- MemberFirst will cover one delinquent payment – MemberFirst will cover up to one delinquent payment if applicable.

- MemberFirst provides extremely competitive pricing – MemberFirst utilizes a four-tier pricing system, providing some of the most competitive pricing available, on a product whose features have no equal.

When you look at the quality, features and pricing of the MemberFirst, Guaranteed Asset Protection (Gap) program there truly is no other option!

*Please refer to a Gap contract for a complete listing of coverages as well as terms and conditions.